Posted on: June 22, 2020

FINREP COVID 19 – EBA Requirement

The European Banking Authority (EBA) advised on 2 June that it is to introduce new FINREP templates on exposures affected by measures to address the effects of COVID 19. These forms are to apply for eighteen months. The first report reference date was stated as 30 June 2020 with submission by 11 August. As at 22 June 2020, Whistlebrook understands that the EBA will issue validation rules and a data point model in due course.

It is also understood that firms reporting a subset of FINREP under the requirements of the Prudential Regulation Authority (PRA), will not be subject to this new requirement at this time. The PRA may issue guidance in the future.

The templates and further details provided by the EBA are available in https://eba.europa.eu/eba-issues-guidelines-address-gaps-reporting-data-and-public-information-context-covid-19.

New Regulatory Regime for Investment Firms

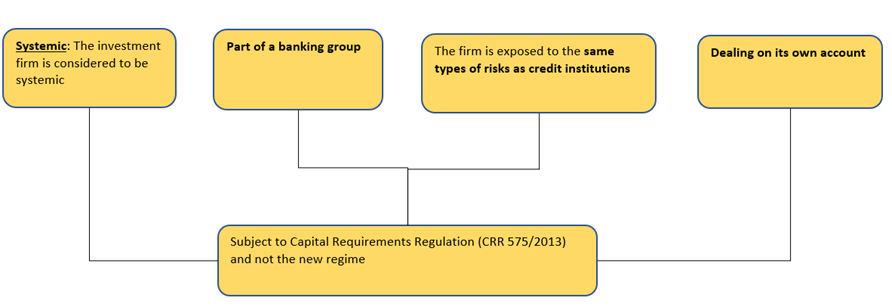

Certain investment firms will be subject to new rules that will replace the application of the Capital Requirements Regulation (CRR). It is Whistlebrook’s understanding that firms with the following characteristics will remain under CRR.

The new regulations introduce reporting and disclosure requirements. The first report reference date will be 30 September 2021 and rules on disclosures will be effective from 26 June 2021.

Where a firm is deemed to be ‘small and non-interconnected’, its reporting requirements are proportional relative to those of a larger organisation.

Further details are available in EBA consultation paper 2020-07 as well as in the Investment Firms Regulation (IFR) EU Official Journal 2019-2033.

EBA Treatment of Software Assets

The EBA issued a consultation paper (2020-11) regarding an exemption from the deduction of software assets from Common Equity Tier 1 capital. The date for responses to this paper is 9 July. Whistlebrook understands that it is proposed a deduction of the firm’s carrying amount, will not be required where the prudent value should not be negatively affected in response to a firm experiencing resolution, insolvency or liquidation.

Under the proposal:

Amount to be deducted from CET1 = Accumulated Depreciation under the proposed rule – Accounting Accumulated Depreciation and any losses on the software

The carrying amount reduced by that deducted from CET1 would be risk weighted at 100%.

Further details are in the consultation paper 2020-11.

Directive on Administrative Cooperation (DAC6)

It is understood that mandatory disclosure of cross border tax planning arrangements is required to be provided to the relevant tax authority. The mandatory disclosure commences from 1 July.

This information was last updated 22nd June