Posted on: July 8, 2020

Pillar 2A

The PRA issued policy statement 15-20 (follow up to consultation paper 2-20) regarding changes to Pillar 2A. Based on a risk environment that the PRA considers to be “standard”, the regulator is going to increase firms’ countercyclical capital buffers for exposures in the UK. Such increases will be offset by reductions in the variable part of Pillar 2A capital. It is understood that loss absorbing capacity will not be compromised.

The view is that the buffer allows firms to draw down as required, rather than have certain risks capitalised in Pillar 2A when they may arise only infrequently.

Firms affected, will see the change by 16 December 2020.

It is also understood that the regulator will increase a firm’s PRA Buffer by 56% of any variable element of Pillar 2A reduction.

Fraud Reporting and Payment Service Providers

On 26 June, the FCA issued a reminder that payment service providers must, with effect from 1 July 2020, collect additional data on fraudulent transactions covering the following:

- Payment was initiated by the seller

- Strong customer authentication was not used in circumstances that are different to the availability of an exemption and to where the seller initiated payment

COVID 19 – Permitted Delays to Regulatory Reporting

The PRA advised on 26 June that it now expects submissions to be made on time.

FCA returns to be received by 30 September 2020, can be submitted up to two months late, but that delay is restricted to the DISP Complaints submission.

CRR “Quick Fix”

The European Parliament issued Official Journal 2020-873 which brings forward some regulatory changes planned for CRR2 (June 2021), to be effective immediately. Following publication of this journal, the PRA issued a statement to specify the regulatory adjustments to be applied by PRA regulated firms. Whistlebrook understands these modifications to be effective from 27 June 2020, are:

- SME supporting factor upper limit raised from €1.5million to €2.5million. An exposure exceeding that limit can be reduced by 15% when calculating the portion of risk weighted exposures to be subject to own funds requirements. Full details can be found in Article 501 of CRR2.

- Introduction of an infrastructure projects supporting factor whereby the risk weighted exposure can be reduced by 25%. Please refer to Article 501a of CRR2.

- Non-deduction of software assets as part of intangibles in COREP CA 01.00. It is understood that these assets should not be expected to have an adverse ‘material’ decline in value were a firm to fail. Please be aware that there is an outstanding consultation paper (EBA 2020-11) regarding ‘materiality’. Therefore it may be prudent for firms to continue with the deduction until the final technical standards have been issued by the European Banking Authority.

- IFRS 9 expected credit loss provision transitional add back to Common Equity Tier 1 capital is revised to allow 100% in 2020 and in 2021.

- Option for a firm to exclude unrealised gains & losses on government debt instruments measured at fair value through other comprehensive income

Further details are available in:

OJ 2020-873 – https://eur-lex.europa.eu/eli/reg/2020/873/oj

PRA Statement – https://www.bankofengland.co.uk/prudential-regulation/publication/2020/statement-on-CRR-quick-fix

CRR2 – https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=OJ:L:2019:150:FULL&from=EN

CRR2 Reporting Templates

The EBA has issued revised templates that will be effective from report reference date 30 June 2021. These templates introduce reporting for:

- Prudential Backstop (COREP)

- Net Stable Funding (revised)

- Counterparty credit risk

There are also changes to leverage ratio and large exposures forms. FINREP has new requirements to include Purchased and Originated Credit Impaired exposures.

The revisions made by the regulator will be included in Wires.

New Regulatory Regime for Investment Firms

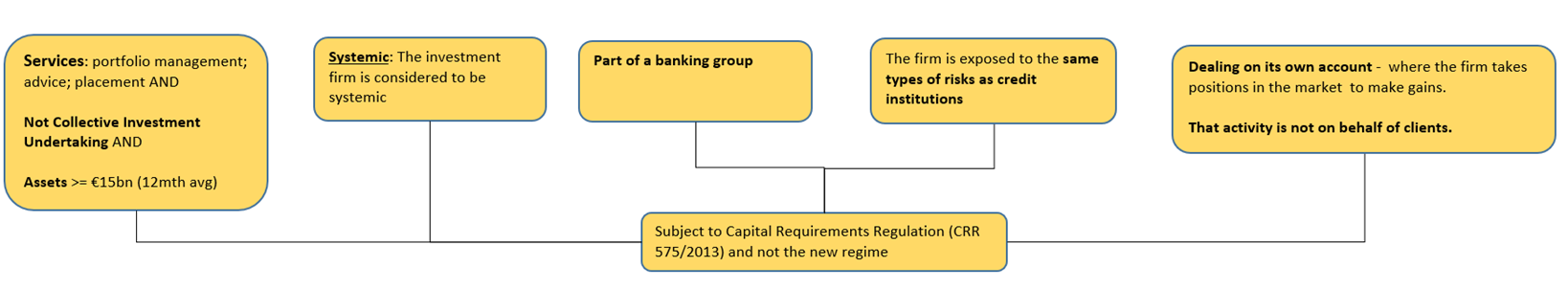

Certain investment firms will be subject to new rules that will replace the application of the Capital Requirements Regulation (CRR) to such institutions.

The new regulations introduce reporting and disclosure requirements. The first report reference date will be 30 September 2021 and rules on disclosures will be effective from 26 June 2021.

Where a firm is deemed to be ‘small and non-interconnected’, its reporting requirements are proportional, relative to those of a larger organisation.

It is Whistlebrook’s understanding that firms with the following characteristics will remain under CRR.

Further details are available in EBA consultation paper 2020-07 as well as in the Investment Firms Regulation (IFR) EU Official Journal 2019-2033.

This information was last updated 8th July