Posted on: August 25, 2022

Bank of England Statistical Returns

Whistlebrook understands that by the end of this year, OSCA will have been withdrawn and replaced by BEEDS. Firms will be getting on-boarded such that their statistical returns are submitted to BEEDS instead of OSCA. In order to make such submissions, it is necessary that clients use the new versions of the Bank of England’s forms that are in WIRES. Use of the layout for collection by OSCA will not work for BEEDS. The change is in line with the regulator’s requirements.

For example, the Bank of England’s form AD (Analysis of Deposits) to be reported to BEEDS is split into two – AD.01.01.01 and AD.02.01.01.

Currently, direct transmission of data to BEEDS is not possible. The Bank of England has not set a date by which time, it will provide an interface to BEEDS. Therefore, manual upload of the appropriate XBRL files will be required to be made in BEEDS, for the time being.

Bank of England Taxonomy 1.3.0

In August 2022, the Bank of England issued a consultation on a new taxonomy (1.3.0) that will implement submission of Statistical Return form IPA (Issuing and Paying Agents), in XBRL format. Once the taxonomy has been finalised by the regulator, the appropriate changes will be made available in Wires.

Pillar 3 Liquidity Disclosure

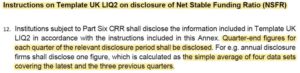

The disclosure template for Net Stable Funding (LIQ2) has been revised in accordance with the instructions of the PRA, in its policy statement 7-22. The data to be reported are to be calculated as averages of previously submitted quarter end figures. A revised custom report with amended calculations, will be available in the next release of Wires.

Please refer to the PRA’s instructions on Pillar 3 disclosures for Net Stable Funding (screenshot below).

Leverage Ratio Reporting

WIRES clients are reminded that for reporting leverage ratio data, the new LV forms must be used. The EBA’s COREP templates have not been effective since 1st January 2022.

UK Countercyclical Capital Buffer

For exposures to UK counterparties, the buffer percentages will be increased as follows.

- 0% to 1% from 13 December 2022

- 1% to 2% from 5 July 2023

This regulatory update is Whistlebrook’s understanding of the position as at 25th August 2022.