Posted on: July 4, 2023

I recently had the pleasure of hosting a webinar on the benefits of applying IRRBB analysis to future balance sheets. In concluding the webinar, I invited to the audience to consider the question above and this is discussed further in this article.

Spoiler alert – the answer is no.

As part of a thought experiment, I pictured a risk analyst undertaking an IRRBB analysis on their current balance sheet at the beginning of 2022.

Interest rates had been flat for a long time, and although there were increasing signs of an invasion of Ukraine by Russia, it was by no means widely accepted as a certainty.

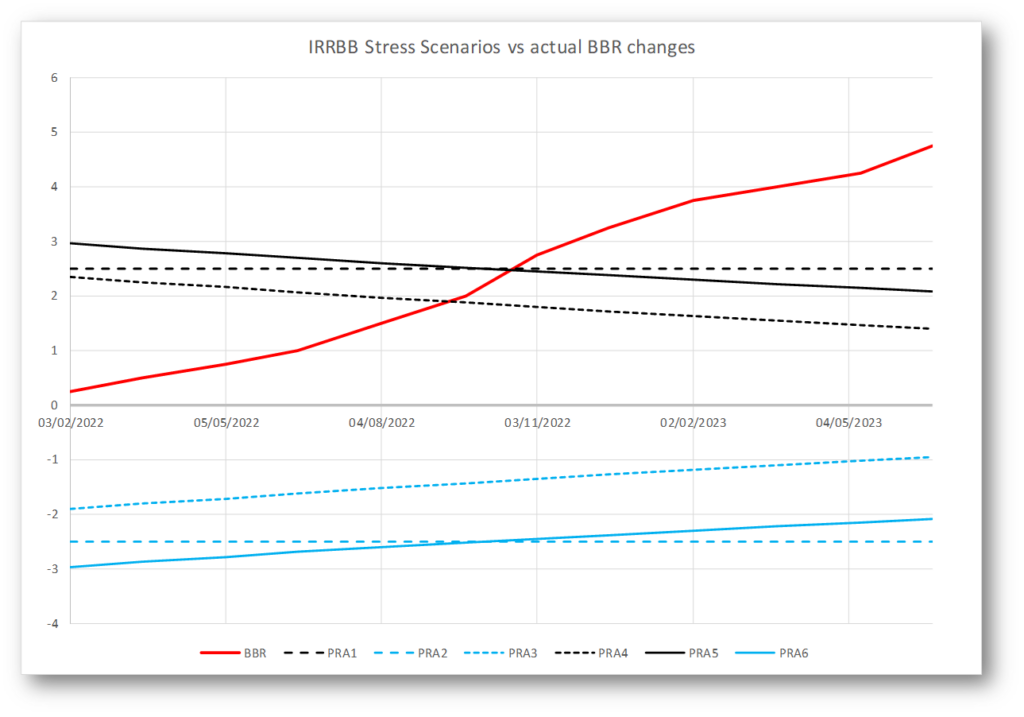

In the hypothetical institution in which our risk analyst found themselves, the risk appetite statement and policy framework required the IRRBB analysis to consider the regulator-recommended six standard IRRBB stress scenarios – (parallel up [PRA1], parallel down [PRA2], steepener [sic] [PRA3], flattener [PRA4], short rates up [PRA5], short rates down [PRA6]).

With the benefit of hindsight, we can compare the scenarios that the analyst prepared and applied with the actual interest rate movements over the short-term risk horizon.

What is striking, and perhaps unsurprising, is that none of the prescribed scenarios adequately describe the stresses that were to occur. We can therefore reasonably conclude that our analyst’s view of short-term interest rate risk was optimistic at best – not a situation any institution would welcome.

Whilst interest rate rises were on the cards at that time, the base interest rate curve is likely to have reflected a somewhat more conservative view and is unlikely to have included the same significant and sustained increases.

There are two issues at play here. Firstly, the standard scenarios all assume a significant and instant rise or fall in interest rates. Even in 2008/09, it took over a year for rates to fall from 5.5% to 0.5%. In contrast, the Bank of England did lower the base rate in response to the COVID crisis with two unscheduled falls in quick succession. However, as this action started from a very low base, it isn’t possible to say with certainty that this action would have resembled the sharp shock described by stress scenarios PRA2, 5 or 6, had the opportunity been there.

The second issue is that in a period of sustained low interest rate volatility, indicators of future volatility may not be immediately apparent, and there is likely to be a natural resistance to predicting large increases given the preceding history.

In conclusion, in order to safeguard against these stresses, institutions must broaden their range of stress scenarios that are routinely applied during IRRBB analysis. This should extend to varying the rate of change and the period over which that change is experienced.

For an institution to do this effectively, a systemic approach to IRRBB will be needed to manage the analysis across a significantly larger number of stress scenarios.

I’ll close with a final thought on how these scenarios may be constructed. Could these additional scenarios be sourced directly from the Bank of England’s own historical data?

By layering your interval range at multiple different starting points over the long-term base rate curve, determining the rate at each of the midpoints and then netting off the rate from the starting point, a series of interest rate ‘stress’ scenarios can be created that reflect actual events.

This portfolio of scenarios may be a good foundation to be extended with your own additional models.

Steve Byfield, Product Director at Whistlebrook

This update is Whistlebrook’s understanding of the position as at 30th June 2023.